Update for Payroll Checks

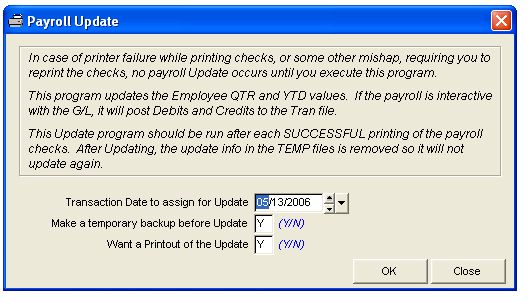

This program updates the employee quarter and year to date values. If you made Payroll interactive with the general ledger, it will also post debits and credits to the Transaction file.

Select Payroll - Update

You should make a temporary backup before updating your payroll and print out the update report. It's very easy to Restore this Payroll Backup, should you have a need.

This update program should be run after each successful printing of the Payroll Checks. After updating, the update information in temporary files is removed so it will not update again.

Caution: You cannot update payroll for a new quarter until you close the previous quarter. You cannot update payroll for the current year until you print W-2's, year-end reports & zero employees year to date values for the previous year.

The transaction date is used for the debits and credits added to the Transaction file. This date has no bearing on updating quarterly and year to date data in the QTRYTD file.

FILES AFFECTED WHEN PAYROLL CHECKS ARE UPDATED

QTRYTD - Employee quarterly and year to date values.

EMP - Re-sets the employee pay period hours to zero. If you made Payroll interactive, it will also post debits and credits

TRAN - The general ledger number for your checking account as specified in the print checks filter and the general ledger numbers as specified under File, Setup Options, Payroll Features are used.

BANK - The Bank program will be updated for checks that were written to the employee.

Related Topics

SetUp Features for Payroll ~ How to Install New Tax Tables ~ How to Change Format of the Checks ~ Checks Used by Roughneck ~ How to Format Names for W2 Printing ~ Employee Master File ~ FAQ about Payroll

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.